Congress Moves To Boost New Founders (INVEST Act of 2025 (H.R. 3383))

The House passed the INVEST Act of 2025, a bill that aims to strengthen American entrepreneurship by expanding capital access, improving federal data, and modernizing how the country supports new business creation.

What the INVEST Act Does

The INVEST Act (H.R. 3383) is part of a bipartisan effort to rebuild the country’s startup capacity. The bill is designed to improve how the federal government measures entrepreneurship, directs resources, and supports new founders. Senator Mark Warner and a cross-party group of lawmakers championed the legislation.

The Act focuses on four major gaps. First, the country lacks clear, real-time federal data on business formation. Second, many early-stage founders struggle to access capital. Third, startup ecosystems are uneven across states and regions. Fourth, too many federal agencies operate with outdated tools that do not match current market conditions.

The legislation proposes new reporting requirements, better data standards, and a coordinated federal approach to understanding how new firms start and grow. It also creates pathways for more consistent research on entrepreneurship and business trends across the country.

The goal is simple. Better data leads to better decisions, and better decisions lead to stronger economic outcomes.

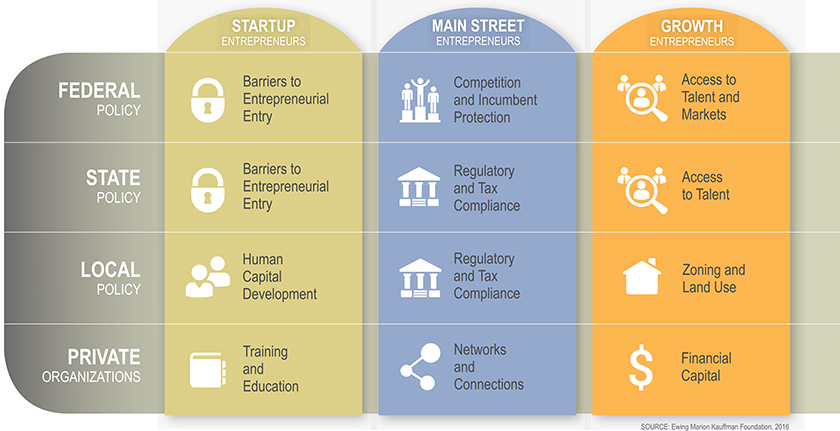

Source: Ewing Marion Kaufman Foundation

Why the Bill Matters Now

New business creation in the United States has been uneven for years. Some regions show steady growth. Others show decline. The House bill recognizes that entrepreneurship is not just a private-sector issue. It is a national economic indicator. Federal agencies cannot support founders well if they do not understand what is happening in real time.

The Act also acknowledges disparities among founders. Research from StartupsUSA shows that founders of color face systemic barriers in capital access, network reach, and early-stage support. These barriers reduce the country’s overall competitiveness.

The INVEST Act highlights that innovation thrives when more people participate in it. A more inclusive entrepreneurship economy is not a political stance. It is a productivity stance. The bill’s sponsors point out that the United States cannot afford stagnant business creation or declining founder diversity if it hopes to remain competitive.

Small Businesses and Startups Feel the Same Pressures

Although the legislation focuses on startups, the broader message is clear. Entrepreneurship today requires better tools, better information, and stronger support systems. Founders face rising costs, complex markets, shifting regulations, and uneven access to mentors or capital. Small businesses feel these pressures as much as high-growth startups.

The INVEST Act aims to give policymakers a clearer view of these challenges. Agencies would be better positioned to track early-stage activity, identify gaps, and design programs that match real needs. Instead of relying on outdated datasets or assumptions, the federal government would have a clearer picture of how new firms are forming, growing, or failing.

For small businesses in cities like San Antonio, where entrepreneurship drives job creation, data clarity affects everything from ecosystem funding to local program development.

Why Better Data Improves Policy

Federal small business policy often lags behind economic reality. Much of the country’s business data is delayed by years. By the time policymakers see the trend, the market has already shifted. The INVEST Act updates how federal agencies gather information so that support programs can adjust faster.

It also reduces the guesswork. Policymakers will be able to see which regions are producing new firms, which industries are falling behind, and where capital shortages are most severe. This matters for public spending, economic planning, and community development.

Good data also strengthens private-sector decision-making. Banks, investors, corporations, and regional economic developers gain clearer insight into where new businesses are emerging and what support they need.

Why Founders of Color Are Central to the Debate

The bill’s sponsors highlight that many high-potential founders do not get enough early support. Studies from StartupsUSA show that improving access for founders of color boosts job creation, strengthens innovation ecosystems, and increases the nation’s economic output. Diverse founders are more likely to serve overlooked markets and create new product categories.

But without accurate national data, policymakers cannot identify where these founders excel or where they face barriers. The INVEST Act brings transparency to those gaps, which can lead to more effective, targeted interventions.

In cities with large minority populations, including San Antonio, better data could unlock stronger ecosystem investment and more equitable distribution of resources.

How This Affects the Future of Entrepreneurship

If enacted, the INVEST Act would influence how agencies, cities, and states track entrepreneurship. It could reshape federal grants, small business programs, and procurement strategies. It may also help regions make smarter decisions about where to invest in training, infrastructure, and support organizations.

A more accurate national picture could help identify what works, what fails, and where the country should focus its entrepreneurial development efforts. It also supports a long-term shift away from reactive policy and toward proactive planning.

Innovation grows when founders have clarity, support, and access to the right tools. The INVEST Act tries to create that foundation.

If you want help understanding how federal changes may affect founders, or if your organization needs support with training, innovation programs, or ecosystem development, Emerge and Rise can help. We guide new and growing businesses through strategic planning, capability-building, and operational design. Contact Us!

Your donations make our work possible.

When you give to Impact, you provide resources that transform the community.