Build Your Financial Future

business wellness tools

Master budgeting, investing, and planning with our Financial Literacy tools and resources, designed to help you make informed financial decisions for long-term success.

credit bureaus

Our Favorite Money Videos

Hidden Financial Gems

Consumer Financial Protection Bureau

U.S. government agency dedicated to making sure you are treated fairly by banks, lenders and other financial institutions.

The Financial Literacy and Education Commission

A U.S. government website dedicated to teaching the basics of financial education.

National Endowment for Financial Education

NEFE provides free financial education resources and tools for managing personal finances.

360 Degrees of Financial Literacy

An initiative by the American Institute of CPAs offering free tools and resources on personal finance.

Federal Trade Commission Consumer Information

FTC offers advice on money and credit, including managing debt and avoiding scams.

America Saves

A nonprofit campaign that encourages saving and provides resources to help build financial security.

From Our Financial Library

-

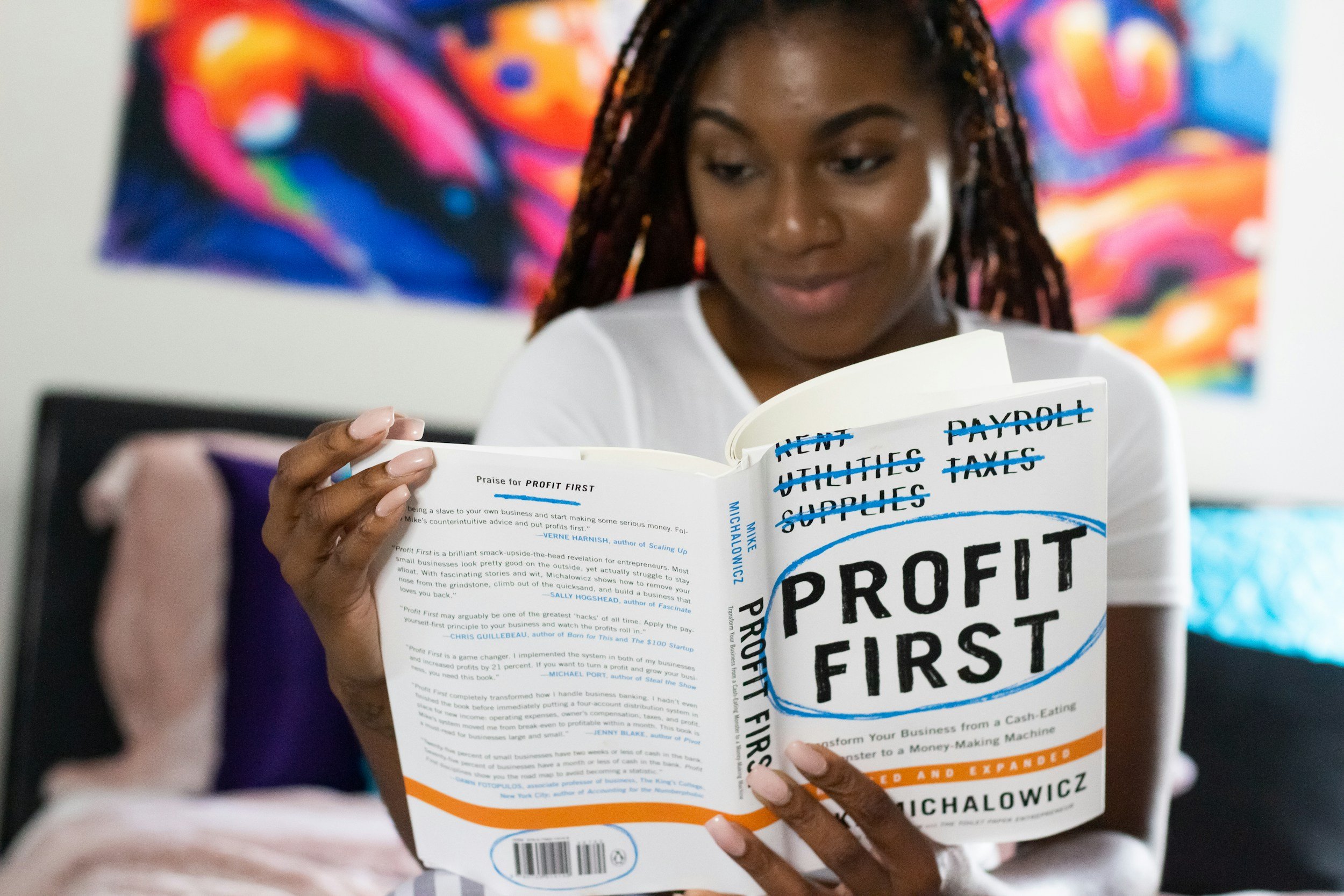

"Profit First" by Mike Michalowicz

Introduces a counterintuitive cash management system that helps businesses achieve profitability by prioritizing profit over expenses.

-

"Rich Dad Poor Dad" by Robert T. Kiyosaki

Explores the differences in mindset and financial strategies between the author's "rich dad" and "poor dad," offering practical advice on wealth-building and economic independence.

-

"Your Money or Your Life" by Vicki Robin and Joe Dominguez

Offers a comprehensive program for transforming your relationship with money and achieving financial independence through mindful spending and saving.

-

"Wealth Your Way: A Simple Path to Financial Freedom" by Cosmo P. DeStefano

Practical path to financial freedom, without the fluff. This isn't another generic money book telling you what to buy or which "system" to follow. Instead, it's a powerful roadmap that helps you build your own decision-making framework so you can create lasting wealth and live life on your terms.

-

"I Will Teach You to Be Rich" by Ramit Sethi

A practical guide to personal finance for young adults, covering topics like budgeting, investing, and automation to achieve financial success.

-

"Get Good with Money" by Tiffany Aliche

A practical guide to achieving financial wholeness through ten simple steps, covering everything from budgeting to investing and debt management.

-

"The Infographic Guide to Personal Finance" by Michele Cagan CPA, Elisabeth Lariviere

With this easy-to-follow illustrated personal finance guide, you can balance your budget, plan for your future, and breeze through confusing details.

-

"The Psychology of Money" by Morgan Housel

In The Psychology of Money, award-winning author Morgan Housel shares 19 short stories exploring the strange ways people think about money and teaches you how to make better sense of one of life’s most important topics.

What We Are Listening (podcasts)

-

Entrepreneurs on Fire

Hosted by John Lee Dumas, this podcast features interviews with successful entrepreneurs who share their stories, including the highs, lows, and lessons learned. It’s a great source of inspiration and practical advice for anyone on their entrepreneurial journey.

-

The $100 MBA Show

This podcast, hosted by Omar Zenhom, provides practical business lessons and insights in a concise format. Episodes typically run 10-15 minutes and cover various topics, including sales, marketing, and business strategy, making it ideal for busy entrepreneurs looking to learn on the go.

-

How to Money

Hosted by Joel Larsgaard and Matt Altmix, this podcast offers financial advice specifically tailored for millennials. The hosts cover a variety of money-related topics, from budgeting and investing to financial independence, in a casual and engaging manner.

Our Favorite TEDx Talks

TOOLS & RESOURCES

-

is a website dedicated to enhancing financial confidence and preparedness for the future. It provides educational resources and tools on insurance, budgeting, investing, retirement planning, and business ownership. The site includes articles, calculators, and research to help users make informed financial decisions and improve their financial literacy. Additionally, it offers insights into holistic financial protection and strategies for achieving long-term financial stability.

Read More ➡️

-

helps create a detailed monthly budget by categorizing expenses and income. It includes fields for various income sources and expense categories like housing, utilities, groceries, transportation, and entertainment. The tool provides a clear visual breakdown of spending, helping users identify areas to adjust for better financial management. It is a practical resource for anyone looking to track and optimize their monthly finances.

Read More ➡️

-

is a financial technology company offering tools and services for personal financial management. It provides users with personalized insights, budgeting tools, and investment advice to help them manage their finances more effectively. Empower also offers retirement planning resources and wealth management services to simplify financial planning and help users achieve their financial goals.

Read More ➡️

-

(You Need a Budget) is a budgeting software and personal finance tool designed to help users gain control of their money. YNAB emphasizes a proactive approach to budgeting with its four-rule method: Give Every Dollar a Job, Embrace Your True Expenses, Roll with the Punches, and Age Your Money. The platform offers educational resources, workshops, and mobile apps to assist users in tracking expenses, setting financial goals, and reducing financial stress.

Read More ➡️

Empower Dreams: Join Us in Building Business Futures

Every donation fuels the journey of aspiring entrepreneurs in our community. Your support enables Emerge and Rise to provide essential resources, mentorship, and training to those who need it most. Together, we can transform potential into success. Invest in a brighter future today—every contribution makes a difference!