Mastering SBSS: Your Guide to Business Credit Scores

Source: QuickBooks

Small business owners often overlook a critical factor in their financial health: the Small Business Scoring Service (SBSS) credit score. Lenders use this score to assess businesses' creditworthiness, and it can significantly impact access to financing and favorable terms. Understanding and managing your SBSS credit score is essential for business growth and stability.

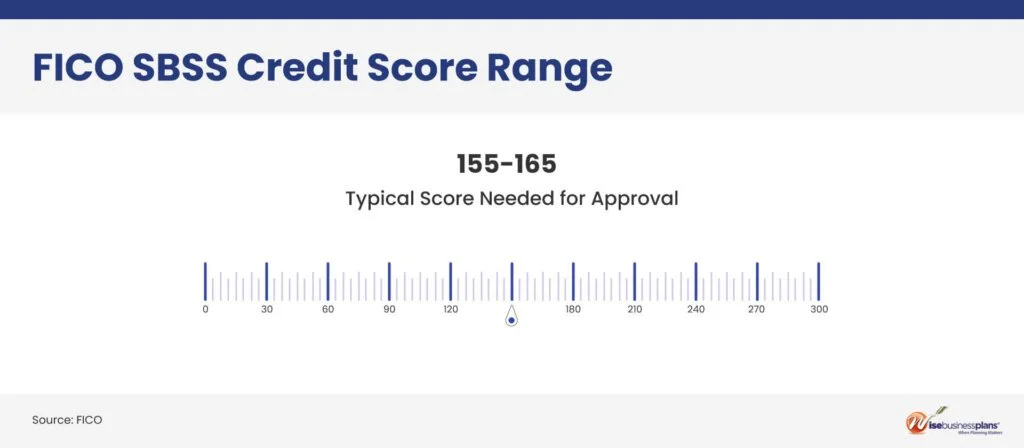

The SBSS credit score is a numerical representation ranging from 0 to 300, with higher scores indicating lower risk. This score evaluates various factors such as personal credit history, business credit history, financial data, and other indicators. Major lenders, including the Small Business Administration (SBA), use SBSS scores to pre-screen loan applicants, making it a crucial element in the loan approval process.

The Importance of SBSS for Small Businesses

A strong SBSS score opens doors to numerous financial opportunities. Lenders use this score to determine the likelihood of loan repayment. A high SBSS score increases the chances of securing loans and lines of credit, often with lower interest rates and better terms. This access to capital is vital for funding business expansion, purchasing inventory, or managing cash flow.

For small businesses in San Antonio, maintaining a high SBSS score can be a game-changer. It can mean the difference between securing a necessary loan to grow and facing rejection. Moreover, a good SBSS score can help negotiate better terms with suppliers, leading to cost savings and improved cash flow management.

Source: Wise Business Plans

How SBSS Scores Are Calculated

Understanding the components that make up an SBSS score is the first step in managing it effectively. The primary factors influencing SBSS scores include:

Personal Credit History: This includes the credit scores of the business owners. Personal financial behavior plays a significant role in determining the business's creditworthiness.

Business Credit History: This considers the business's credit accounts, payment history, and credit history length.

Financial Data: Revenue, profit margins, and other financial metrics are analyzed to assess the business's financial health.

Public Records: Bankruptcies, liens, and other negative public records can significantly lower the score.

Industry Risk: Some scoring models consider the inherent risk associated with the business's industry.

Steps to Improve Your SBSS Score

Source: Fit Small Business

Improving an SBSS score requires strategic financial management and proactive measures. Here are actionable steps small business owners can take:

Maintain Strong Personal Credit: Ensure that personal credit scores are healthy, as they significantly impact the SBSS score. Pay bills on time and keep credit utilization low.

Build Business Credit: Establish business credit accounts and manage them responsibly. Pay suppliers and creditors on time and keep credit balances low.

Monitor Financial Health: Regularly review financial statements to ensure the business is profitable and maintaining healthy margins.

Avoid Negative Public Records: Manage finances responsibly to avoid bankruptcies, liens, or other negative records.

Check Your SBSS Score Regularly: Regular monitoring can help identify areas for improvement and ensure that the report is error-free.

Why Emerge and Rise™ Matters

At Emerge and Rise™, we are dedicated to empowering small businesses in San Antonio by providing the tools and resources necessary to thrive. Our financial literacy programs are designed to educate entrepreneurs about the importance of SBSS scores and how to manage them effectively. Through our Lotus Business Readiness Program and ThriveXcelerator Program, we offer comprehensive support to help businesses build and maintain strong credit profiles.

Understanding and managing your SBSS score is crucial for small business success. It not only enhances access to capital but also improves relationships with suppliers and attracts potential investors. At Emerge and Rise™, we are committed to guiding small businesses through this journey, ensuring they have the knowledge and support needed to achieve their full potential.

Ready to take control of your SBSS score and drive your small business to new heights? Contact Emerge and Rise™ today to learn more about our financial coaching and how we can help you succeed. Let us support your journey to financial stability and growth.

Your donations make our work possible.

When you give to Impact, you provide resources that transform the community.